How Ag Fintech Is Transforming Brazilian Agribusiness and Its Access to Rural Credit

For the past 5 years I have shared articles on PrecisionAg about digital agriculture in Brazil. In that time, my country has evolved immensely in terms of using ag technology to manage farms. It has been an incredible transformation. Now, as I look ahead, I think the next great revolution in Brazilian agriculture will be access to rural credit. And things are already moving quickly on that front.

Let’s look at some of the numbers:

- For the 2021/22 season, there was demand for credit in Brazilian agriculture of approximately US$170 billion.

- The Brazilian government allocated more than US$35 billion and the rest was distributed among banks, cooperatives, resellers, input companies, and trading companies, in addition to the producer’s capital.

- Brazil has more than 6 million rural properties, according to the Agricultural Census of the Brazilian Institute of Geography and Statistics (IBGE) 2021.

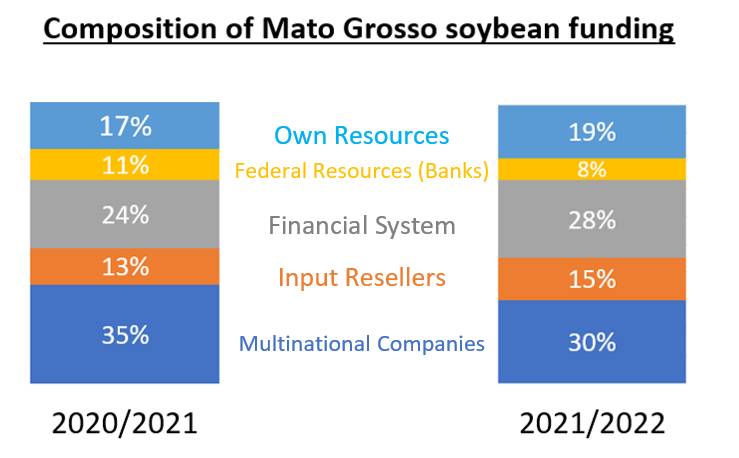

Due to factors such as regional diversity, large number of properties, diverse agricultural crops, complex credit analysis, many investment funds have been out of this market for a long time due to this complexity but that is changing. For example, the state of Mato Grosso, which is the largest producer of soybeans, illustrates this point in the graph below:

Source : Mato Grosso Institute of Agricultural Economics – IMEA 2021

In this graph, we see a decrease in access to federal funds and an increase in other sources. I have many clients who are capitalized and are making purchases with their own resources.

MORE BY MAURICIO NICOCELLI NETTO

How a Digital Platform Is Creating Transparency with Brazilian Harvest Data and Bringing Security to Investors

Brazilian Agtech Startup Brings Aerial Application Management Platform to North American Market

What’s New?

In the last few years, some startups have emerged that have revolutionized access to capital in Brazil. One of these companies is Traive, which started its journey in 2018 in the U.S. as a research project from MIT (Massachusetts Institute of Technology). Traive facilitates the bridge between investment funds, the inputs industry, and resellers in Brazil. All analysis is done with the use of the platform. At the end of last year, this startup closed a partnership with Syngenta in Brazil in capital of US$153M to farmer financing. It digitizes the risk analysis process, from data reception and processing, to credit risk analysis, and connects this data with investment funds.

Another company in this area is Terra Magna, a Brazilian startup that ended 2021 with a credit portfolio of US$120M. In 2022, its perspective is to reach US$250M in credit for the sector. Terra Magna innovation comes from its ability to grant commercial credit in a more assertive way through the analysis of production and the sales flow of producers and their respective financial health. The platform evaluates the history of the producer, its production capacity, and follows the crop through satellite monitoring and other technologies, from planting to harvesting.

For small and medium-sized farmers, there is ag fintech company Agrolend, which finances producers who earn an average of US$100,000 to US$1M per year. The company has been growing rapidly and has already raised more than US$14M to grow. The entire credit process is done easily and quickly via a mobile app.

Thanks to ag fintech companies like the ones mentioned above, Brazilian producers will increasingly have access to the credit they need to grow their businesses in a quick and uncomplicated way. As a result, I expect to see an increase in direct purchases in multinationals and the formation of purchasing groups in the state of Mato Grosso.

Green Bond Credit Market

The green bond market in Brazil has gained strength with the recent launch of the Rural Product Note (Green CPR). The Green CPR issues payment for environmental services provided by the producer, who no longer opens new spaces for vegetation to expand his agricultural production.

The green bond market in Brazil has nearly doubled in two years, from US$5.6 billion issued in 2019 to US$10.3 billion today, as Leisa Souza, head of the Climate Bonds Initiative for Latin America, highlighted at the recent Estadão Summit Agribusiness 2021.

In my view, the green credit market still has plenty of growth potential in Brazil. In other regions of the world, the market is already very mature. But Brazilian rural producers still do not know how to prove the reduction of carbon in operations and there are still many doubts in taxation.

Even with this evolution, I came back with a slight frustration from attending COP26 in Glasgow in November 2021. I believe the carbon credit market would be more democratic and open to the smallest properties but it still isn’t. In my reality, I only see a few large groups with access, but hopefully that will change in the near future. In April, I’m going to participate in the 14th annual Global AgInvesting event in New York, looking to connect with big funds and green funds, and bring those connections to Brazil. This will be one of the biggest global events on investments in agribusiness.

For more information: www.monagriap.com.