Opinion: Agtech Boom Is Yet To Come

Many agronomists, farmers, and VC groups monitoring the agtech world are proclaiming the startup boom is over. Investments are down, acquisitions are high, and many startups go bust.

Perhaps rapid, new growth in the space is fading, but I disagree with calling the space busted. We are simply entering a new leg of the race. Here are the reasons why this is the case:

No widescale adoption

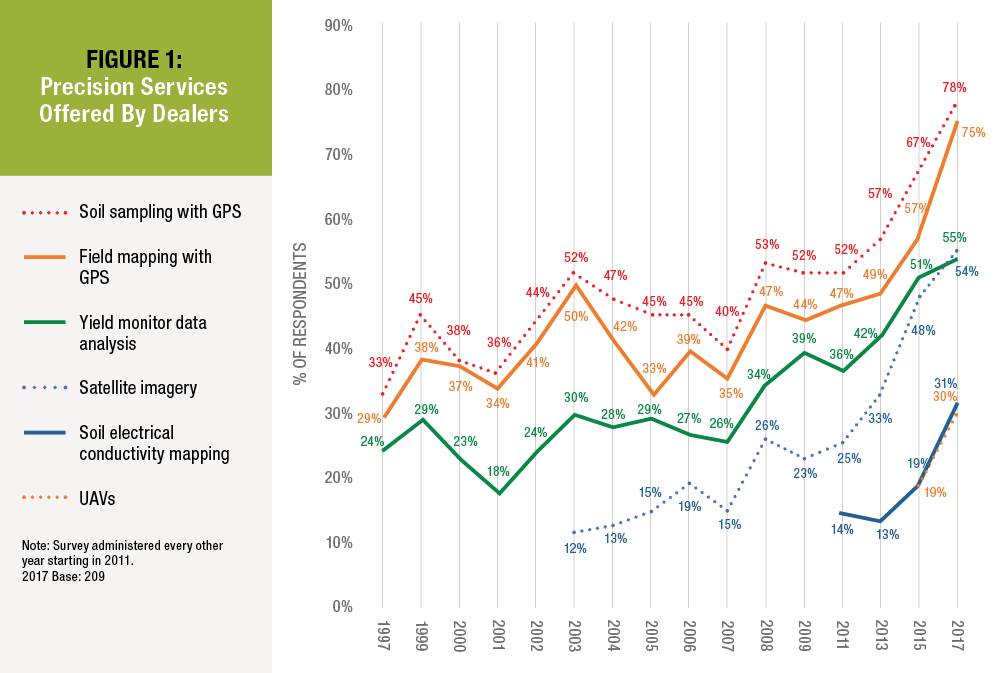

Despite major use of data by growers, we still don’t have that wide-sweeping adoption in the grower market place.

Source: “2017 Precision Dealership Survey: Making the Turn Toward Decision Agriculture,” CropLife/Purdue University.

MORE BY TIM MARQUIS

How Industrial AI Can Maximize the Potential of Agriculture’s Planting Season

What Lessons Can the Ag Industry Learn from the Facebook Data Breach? How to Tell if Your Ag Data is Secure

Part of that is because for years we’ve been hearing about how difficult it is to acquire good clean ag data. We’ve had trouble transmitting it, gathering it, and QCing it. Growers have grown sick of hearing about all the data we need to enhance profits and yields.

No easy, simple solution

Predictive analytics or any type of data science isn’t easy. Farmers have been looking for the “Uber of agriculture.” Many aren’t easy or complete solutions, and the lack of a simple tool has led to skepticism of anyone entering the market.

Too many choices

It’s not just that many options aren’t easy to use that has led to low adoption; it is also that there are simply too many choices. Growers feel overwhelmed by the number of startups. Because of this, many growers won’t even entertain a solution unless it’s free, requires no extra time, or comes recommended from a trusted adviser. That thick wall of adoption has led to the general slowing of new agtech startups.

Growers have been saying: “Have a well-established trusted adviser recommend it. Give out data products for free for a period of time to prove they work. Have solutions that require little added time to the day.” The groups that are most capable of meeting that adoption criteria have historically been the agrochemical-seed companies.

Consolidation

BASF, Bayer, Dow Dupont, and John Deere have led the year in acquisitions. These groups have been acquiring startups and are amassing very large and unique data sets. Other VC backed startups have grown quite large in data acquisition in their own right to compete against the traditional Big 6. They do this by acquiring data through a grass roots approach like Farmers Edge, Farmers Business Network, and FarmLogs. Think of it as the sequoias of the ag revolution have started to dominate the forest. And, believe it or not, that’s exciting for more traditional tech companies to come in to grow the industry, but in ways these ag companies haven’t seen before.

What’s next

In this new growth stage of ag, partnerships with large data companies, not acquisitions, are going to be what changes in agtech. Many agtech companies have achieved their growth and adoption by growing organically. Now, they’re going to need to find ways to compete with fewer players but ones that have capital and data that can grow rapidly.

In order to do that, agtech is going to attract outsiders from Big Tech that they will need to partner with, and that’s going to be uncomfortable. How the major agtech players open up and partner will likely determine which ones win the ongoing adoption and retention battle.